Written by: Dylan Goldberg

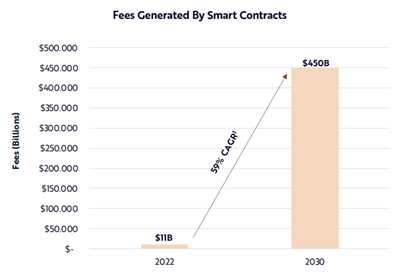

Smart contract networks are blockchain networks that have an underlying infrastructure of computer programs that can automatically execute agreements when the conditions defined for the contract are met by both parties. According to ARK, smart contract networks could generate $450 billion in revenue and could potentially reach $5.3 trillion by 2030. As traders seek greater transparency, they are progressively embracing decentralized exchanges, relinquishing reliance on centralized intermediaries in favor of self-custody solutions. Smart contracts are the solution to greater autonomy and efficiency in delivering contract terms and executing agreements between parties.

Ethereum layer 2 scaling solutions are the main entry point for smart contract delivery, which is meant to improve its scalability and transaction efficiency. Decentralized finance (DeFi) contains the smart contracts responsible for this transparent financial ecosystem. According to ARK, the centralized crypto leaders failed, which led to the increased use of Defi. Per ARK, “As insolvencies mounted across crypto lending businesses like Celsius and Voyager, decentralized lending markets like Aave continued to operate as designed. They processed deposits, withdrawals, originations, and liquidations without service interruption.”

Throughout the last year, the active addresses on the layer 2 networks Arbitrum and Optimism have grown 11x and 19x, respectively. These addresses are being utilized primarily on Arbitrum and Optimism. These layer 2 solutions both enable faster and cheaper transaction methods.

Arbitrum can process thousands of transactions per second while maintaining low latency. Low latency allows for this process to occur and have users complete these transactions. It also offers an enhanced user experience compared to the public Ethereum production blockchain.

Optimism allows for developers to deploy Ethereum smart contracts without changing too much. It is an easily integrated system and contains fast and low-cost transactions. Smart contracts could bring in the ownership of tokenized assets for a smaller cost of the traditional financial services. They provide a transformative technology for decentralized applications and financial systems.

It is critical that smart contract functionality is evaluated for secure coding development practices and that it does not have significant vulnerabilities that could lead to attack or exfiltration. As the usage on scaling solutions like Arbitrum and Optimism continue to grow, attacks will leave consumers and companies open to losing money or access to funds. Examining and maintaining security will become a standard practice and necessity for companies deploying smart contracts as regulation or technical capabilities continues to develop and mature.