Looking back on 2022, a year of hacks, frauds, and FTX’s downfall, it’s reasonable to ask, “Where were the regulators?” It’s a fair question and it’s safe to say that regulators are racing to ensure that the same problems don’t happen again.

Given the general gridlock in Congress, it seems unlikely that the US will see any sweeping new legislation covering crypto. That means the regulation-by-enforcement environment that has existed to date will continue, but with more urgency now. One of the outcomes of not expecting new legislation is that regulators like the SEC and CFTC will need to force crypto companies into an existing regulatory framework. More digital assets will be deemed to be securities. Staking, yield farming, and bank-like products will get fresh, hard looks. Crypto exchanges will be regulated like equity exchanges.

The one area that has even a remote possibility of seeing Congressional action is stablecoins. Despite the disruption and volatility in the crypto markets in 2022, stablecoin adoption and trading volume increased throughout 2022, despite the Terra/Luna debacle. Expect that trend to continue into 2023.

Stablecoins are increasingly the lifeblood of the crypto ecosystem, which is exactly what might bring them into the crosshairs of Congressional legislation. Stablecoins, if viewed as digital dollars, can be seen as a threat to broad swaths of the TradFi industry and even to US monetary policy and controls. The US is unlikely to allow a giant “shadow banking” environment to develop without significant regulatory oversight.

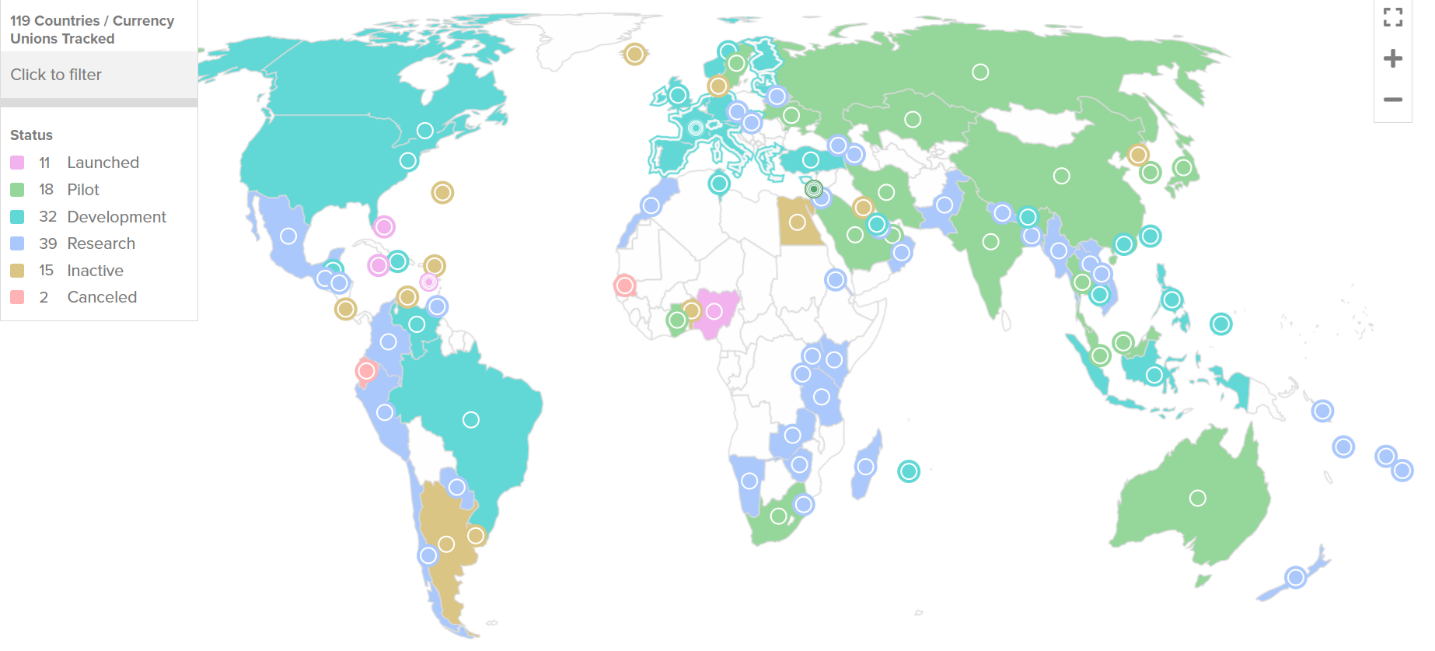

As exhibited by the below figure, there is a significant global investment in a very specific type of stablecoin – Central Bank Digital Currencies (CBDC). Whereas most current stablecoins are issued and controlled by private entities (think Circle’s USDC), a CBDC would be issued by a sovereign government. Although few have been launched, there are over 50 opportunities in the development or research phase, and many countries are currently piloting this use case.

Courtesy of Atlantic Council

Lastly, and potentially most concerning, is a possible push seen over the first few months of 2023 to cut crypto off from traditional banking services. Recently, there have been announcements, pronouncements, enforcement actions, and investigations from several federal bodies including the OCC, FDIC, Federal Reserve, and DOJ. At a minimum, these actions will make it significantly harder for any business in the crypto ecosystem to establish a traditional banking relationship. A troubling trend worth watching as 2023 progresses.

Of course, the crypto industry is not sitting still, but continues to innovate and respond to the changing regulatory landscape. Unfortunately, some companies will use the regulatory “crackdown” as a reason to move offshore. There are plenty of jurisdictions outside the US that are providing regulatory safe havens for crypto companies.

Other companies that see the value and benefit in complying with the highest level of regulatory oversight will stay and adapt. One example of this is the growth in permissioned DeFi protocols. To date, DeFi has been a bit of a wild west (see concerns about “shadow banking” above) with anyone holding the appropriate digital asset able to participate in various DeFi protocols, no questions asked. This is very different from when someone walks into a bank or a brokerage firm and wants to open a new account.

In permissioned DeFi, there is a screening process to ensure new participants comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. This raises questions about how “decentralized” a DeFi protocol really is if there is a third party making KYC/AML assessments. Only with such regulatory guardrails in place will DeFi be able to attract material amounts of institutional capital. Expect to see more crypto product and service offerings that proactively adopt elements of the TradFi regulatory environment, even if it means sacrificing complete decentralization.