There are many significant trends shaping the future of payment processing. As a result, organizations are under increased pressure to keep their position as future-focused, innovative, and responsive to consumer needs. The growing demand for person-to-person payment platforms such as Venmo, Zelle, and other application-based payment services has shown that banks are not the only businesses that can offer convenient payment capabilities. The barriers to entry for the financial services industry are now reasonably low.

As many have learned from past technological advances, there are increased organizational and fraud risks that are presented with these types of services. These risks must be considered and incorporated into an institution’s risk assessment process. As business processes or products evolve, fraud risks change, and they must be evaluated during the new product risk assessment.

The following are examples of how risks related to real-time payments and cryptocurrency fraud can be mitigated.

Real-Time Payment Fraud

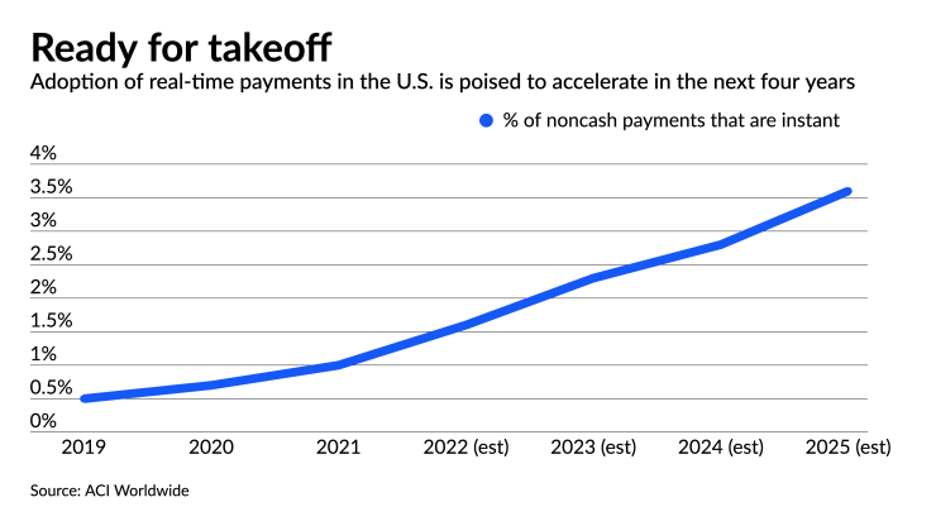

Consumer adoption of advanced payment structures and processing capabilities were prevalent prior to COVID-19; however, the pandemic accelerated the opportunity and acceptance of these new, convenient payment methods. There were approximately 118.3 billion real-time transactions that occurred worldwide in 2021, and this figure is expected to grow.

Below is an illustration of the rapid adoption of real-time and non-cash payments in the United States.

As electronic payments and real-time transfers become more commonplace, fraud risks are expected to increase. One of the best ways organizations can reduce their exposure to fraud risk is by implementing a data analytics-driven solution. This acts as a preventative control to losses related to fraud. Behavioral analytics can help organizations identify emerging fraud risks and behaviors.

These data-driven services require some level of vendor management activity prior to implementation. To learn more about vendor management, particularly for fintech organizations, read our article Top Control Considerations for Fintech Companies.

Data analytics can’t solve it all though. These methods must be used in combination with consumer education on ways to prevent and manage fraud risk.

Cryptocurrency Fraud Impact

Funds that have been fraudulently taken through advanced payment platforms are often diverted into cryptocurrency. This method allows the fraud perpetrator to conceal their identity and create a form of layering, in order to distort the source of the proceeds. As crypto becomes an increasingly accepted payment method, federal regulatory agencies are concerned, but there is no specific regulation of digital payment or cryptocurrency as of yet.

Financial institutions, fintechs, and organizations impacted by this increased risk exposure must now consider the potential fraud risks associated with these payments. Data analytics and artificial intelligence (AI) based solutions will be some of the most powerful tools that organizations can use to mitigate fraud risk in this space. Unfortunately, these same technologies can be used by fraudsters to cause organizations or individuals harm. During the last few years, there has been a drastic increase in the amount of synthetic identity fraud using technologies to breach biometric and other authentication measures. In these instances, predictive and behavioral analytics may help identify and prevent fraud from occurring.

As organizations continue to adopt advanced and emerging payment technologies, it is important to consider the cost-benefit of implementing an AI-based or machine learning solution to prevent and detect fraud.

The following are the necessary steps to implement data analytics or AI-based solutions:

- Risk Identification – Identify the needs of the organization and potential risks that the system is attempting to address

- Risk Assessment – Determine the likelihood and impact of potential fraud risks identified through a risk assessment process

- Cost-Benefit Analysis – Perform a cost-benefit analysis and weigh the potential benefits with the cost of the system

- Implementation Project Plan – Create a project plan that outlines responsibilities and implementation steps

- System Implementation – Deploy the system or advanced analytics solution and execute the implementation project plan

- Validation – Upon implementation, verify that the solution is capturing the information needed and addressing identified risks

Advanced payment processing technology has the potential to offer organizations and consumers mutual benefits; however, emerging fraud risks must be addressed during implementation. Synthetic identity fraud threatens financial institutions and is a growing trend in the current payments environment.

Considering these examples in the fraud risk assessment process will help identify relevant risk, establish controls, and remain within your organization’s risk tolerance. With the proper planning and controls in place, your organization can see the true benefit of these payment channels.