The time has finally arrived for private financial institutions and smaller reporting public companies to record their Day 1 Current Expected Credit Loss (CECL) entries during the first quarter of 2023. Those that have a fiscal year end of December 31st were required to adopt CECL on January 1, 2023, and have subsequently calculated their allowance for credit losses (ACL) under the CECL methodology.

Since the issuance of Accounting Standards Update (ASU) 2016-01, Financial Instruments—Credit Losses (Topic 326), CECL was expected to be one of the biggest changes to financial institution accounting in years. While the previous allowance for loan loss model was an incurred model, the ACL requires estimating credit losses over the life of loan using historical, current, and forecasted data. This has required financial institutions to invest significant resources in both time and software to properly calculate their ACL under CECL. We have analyzed this most recent round of adoption from a few different perspectives using publicly available regulatory filings. Coverage ratios were calculated for each institution as a simple average, rather than using a weighted average.

Banks

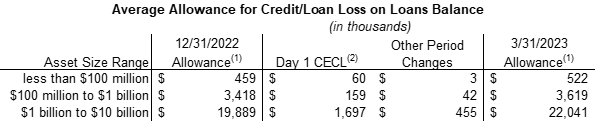

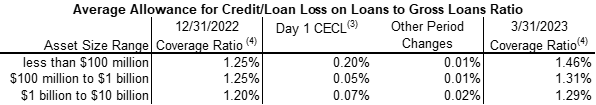

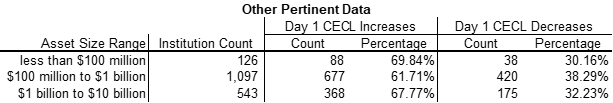

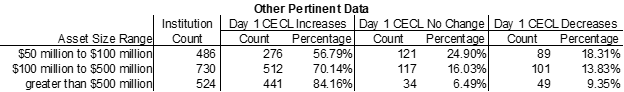

The following tables utilize Federal Deposit Insurance Corporation (“FDIC”) filings as of March 31, 2023. Our focus was on banks with $10 billion in total assets or less that specifically recorded a CECL adjustment to their allowance for credit losses for loans during the quarter. Banks that determined a CECL adjustment was not required as of January 1, 2023, are not included in the synopsis below.

(1) Call Report Field: RIAD3123 (2) Call Report Field: RIADC233

(3) (3/31/23 Coverage Ratio-12/31/22 Coverage Ratio)*(Day 1 CECL $/(3/31/23 Allowance-12/31/22 Allowance)

(4) Call Report Field: RIAD3123 / RCON2122

As noted in the above tables, banks of all sizes experienced an increase in their ACL on loans. On a percentage basis this affected smaller institutions, less than $100 million, to a greater effect. The way each bank calculates their ACL can vary widely under generally accepted accounting principles (GAAP); however, inherently on an average basis the increases to allowance on loans was expected, with the switch from incurred to life of loan methodology.

For the population analyzed, although there was an aggregate increase, it is worth noting that about a third of banks did see a decrease in their allowance on loans upon adoption of CECL. While each situation is unique, a general assumption is that banks saw the adoption of CECL as a chance to assess the appropriateness of their prior qualitative adjustments under the incurred model. When starting with historical loss data and forecasting the future under CECL, some banks determined a decrease would be booked compared to their incurred model.

Credit Unions

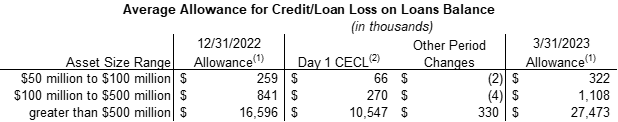

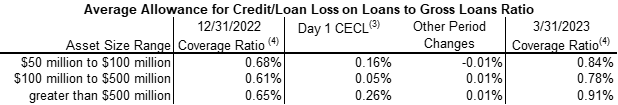

The following tables utilized National Credit Union Administration (“NCUA”) filings as of March 31, 2023. Our focus was on credit unions, greater than $50 million, that specifically adopted CECL during the first quarter of 2023.

(1) Call Report Fields: 719 and AS0048, respectively

(2) Call Report Field: –(12/31/22 719- 3/31/23 550 + 3/31/23 551 + 3/31/23 IS0011 – 3/31/23 AS0048)

(3) (3/31/23 Coverage Ratio-12/31/22 Coverage Ratio)*(Day 1 CECL $/(3/31/23 Allowance-12/31/22 Allowance)

(4) Call Report Field: AS0048 / 025B

Consistent with their bank counterparts, credit unions of all sizes experienced an increase in their ACL on loans on an average basis. On a percentage basis this affected larger credit unions to a greater extent. It should be noted that the greater than $500 million category does contain the country’s largest credit union, which at $166 billion in assets is significantly larger than the mean of $2.9 billion for this peer group. Excluding this institution from the peer group does not change the coverage ratios above, but it would numerically change the allowance and CECL dollar amounts.

In a slightly different trend to banks, the larger the credit union, the more likely they were to record an increase to their allowance on Day 1, with only 15% of the greater than $500 million credit unions recording no change or a decrease. Due to their more consumer-focused and less diverse loan composition in comparison to banks, credit unions may have experienced a more significant increase in the ACL from CECL adoption, particularly when considering the current inflationary environment.

Conclusion

While there are nuances to adoption for each institution, on an aggregate basis, CECL has done what most expected – increase the allowance for credit losses on loans. It’s important to note that loan composition and the chosen CECL methodology can vary among individual banks and credit unions based on their business strategies, market focus, and customer base. Therefore, while some general trends may exist and have been analyzed here, it is essential to understand the specifics of each institution when assessing the adequacy of the allowance for credit losses on loans.

If you have any questions on the above, on your institution’s CECL implementation, or about audit services, our team at Wolf & Company is here to help.