The Tax Cuts and Jobs Act in 2017 brought about sweeping tax reform the likes of which we have not seen since 1986. Corporate taxpayers were introduced to new provisions regarding foreign activity and benefitted from a lower tax rate – but included in these changes was a revenue-raising rule related to research and development expenses that is now coming to the forefront.

Before diving into specifics, an important takeaway is that this provision does not impact a taxpayer’s ability to benefit from the R&D tax credit. Taxpayers that previously qualified for the R&D tax credit will still be able to calculate the credit in the year that the qualified research expenses are incurred despite being capitalized and amortized. Credits will also still be eligible for utilization against income taxes for all taxpayers, and payroll taxes for qualified small businesses (not addressed in this alert).

For tax years commencing after January 1, 2022, taxpayers will be required to capitalize and amortize research and development expenses that were previously eligible for immediate expensing. Defined under Code Section 174, expenses incurred domestically (i.e., within the US) will be amortized over a 5-year period and expenses incurred abroad (i.e., outside the US) will be amortized over a 15-year period. Under the Code, the expenses that are required to be capitalized include more than just the qualified expenses that go into calculating the tax credit but also include indirect costs that can be attributed to research and development activities. These indirect costs include typical overhead costs such as rent expense on facilities and utilities, among others. Additionally, costs incurred in connection with the development of software must be capitalized.

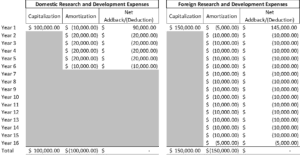

Here is a schedule of how costs will be capitalized and amortized under the Code1:

You are allowed to take a half year of amortization in the year the costs are incurred.

If your company prepares financial statements, then you may already have a method of allocating indirect overhead costs to research and development. If not, then you will need to come up with a method of allocating overhead costs to your research and development activities. The IRS does not define a specific method of allocating indirect costs to research and development, but typically allows for a reasonable and supportable method to be used.

There is still hope that Congress will either delay the implementation of this provision, or remove it from the Code entirely, but until that time we are recommending that companies begin modelling what this provision may mean for their 2022 taxes.

For more information, please contact your Wolf & Company tax team.

1§174(a)(2)(B)