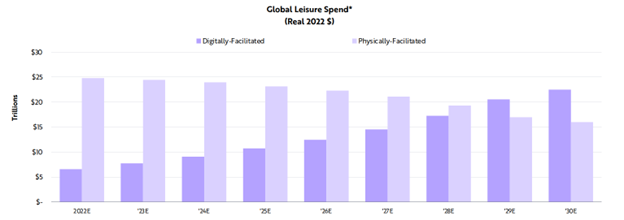

In the now post-pandemic era, consumers have placed priority on the digitization of leisure, looking to remain connected and informed for a more stream-lined digital-only experience. Digital leisure spending has reached $6.6 trillion in 2022 and is expected to reach $22.5 trillion by 2030 with a compound annual growth rate of 17%. Four trends are expected to contribute to this growth: the rise of connected TV (CTV), the emergence of new social platforms, the legalization of online/mobile sports betting, and the convergence of video games and social media. These trends are expected to take share from traditional media and drive revenue growth in the digital leisure industry.

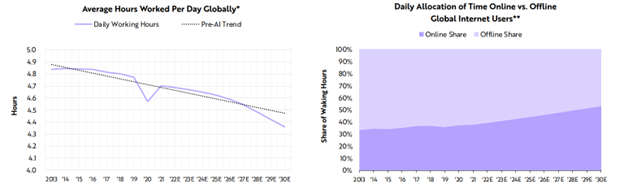

ARK suggests that generative AI could result in a decline in daily working hours globally by 0.9% annually over the next five years, leading to an increase in the share of total waking hours spent online from 39% in 2022 to 53% in 2030. This shift in time allocation is expected to boost the demand for digital entertainment, leading to an increase in the time spent on online activities as compared to offline ones.

CTV advertising has been on the rise in recent years, providing advertisers with targeting and attribution measurement once reserved for traditional digital advertising. Despite this, there is still a significant disconnect between viewership and advertising budgets in the US, indicating that advertisers have yet to unlock the full potential of CTV. However, experts predict that this gap will close within the next five years as CTV continues to grow and take share from other digital ad budgets and linear TV. In fact, total CTV ad spend is expected to grow 20% in real terms at a compound annual rate, from $21 billion in 2022 to more than $50 billion in 2027. Meanwhile, US linear TV ad spend is predicted to decline 8% at an annual rate during the next five years, from $70 billion to $45 billion by 2027. With improved ad targeting and measurement, CTV advertising is expected to overtake linear TV advertising in the next five years. This could make CTV an attractive option for advertisers looking to capture both brand and performance ad budgets, combining the advantages of both linear TV and digital advertising.

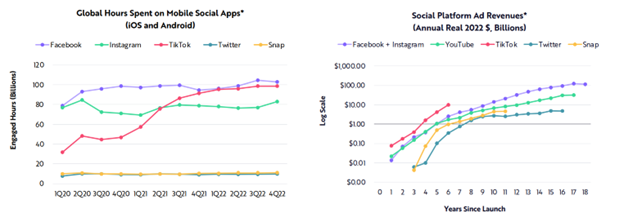

Short-form video platforms and content-based social media are increasingly replacing traditional follow-and-feed social media platforms. In 2022, TikTok and Facebook had roughly equal engagement hours, which could indicate the peak of traditional social media. Despite TikTok’s rapid growth, it accounted for only 2% market share, or $10 billion, of the estimated $470 billion spent on search, video, and social ads in 2022. The trend suggests that content-based social media will capture advertising share more in line with its engagement hours. This shift in consumer behavior reflects a preference for shorter, more immersive experiences and the growing influence of recommendation engines in directing content consumption.

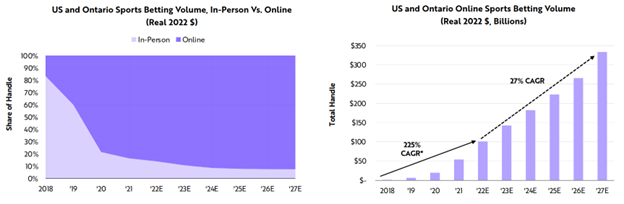

According to ARK’s research, the demand for sports betting remains strong despite the economic downturn, with the total sports betting volume in the US and Canada estimated to have increased by 83% YoY to approximately $117 billion in 2022. The online sports betting segment has shown particularly strong growth, rising from 17% in 2018 to 86% in 2022. ARK predicts that online sports betting will continue to grow at a compound annual rate of 27% in the next five years, reaching $330 billion in 2027, while in-person betting is expected to grow at a slower rate of 11% annually, reaching $27 billion in 2027.

The gaming industry is expected to move towards fully immersive virtual worlds that merge video games and social media, allowing consumers to socialize and entertain in game-supported virtual spaces. This could lead to a shift away from physical environments. ARK’s research suggests that this convergence between gaming and social media will increase gaming revenue growth from 7% to 10% at a compound annual rate over the next five years.

In 2022, NFT trading volume increased by 15%, with high-profile collectibles like Bored Ape Yacht Club and Crypto Punks dominating the market. However, the share of NFTs minted shifted towards utility-based projects like on-chain domain names and digital memberships, indicating a shift towards underlying value rather than speculation. Digital assets, with the introduction of property rights, are predicted to accrue significant value, and ARK forecasts that global NFT transaction volume will grow more than five-fold from $22 billion today to $120 billion by 2027, thanks to decentralized proof-of-ownership.

ARK’s research indicates that digital leisure is still in its early stages, with global consumers spending 21% of their $31 trillion leisure budget on digitally facilitated goods and services in 2022. The demand for digital goods and services is projected to grow 17% annually, surpassing demand for physically facilitated goods and services in 2029.

ARK’s research indicates that several digital trends are set to shape the future of entertainment and advertising in the coming years. Digital leisure is still in its early innings, with the demand for digitally facilitated goods and services projected to surpass demand for physically facilitated ones by 2029. Keep a close eye on this space as trends and innovations continue to develop.

For additional breakdowns of ARK’s research in other areas, head to our Table of Contents.