In November 2022, the U.S. Department of the Treasury issued a report called “Assessing the Impact of New Entrants Non-bank Firms on Competition in the Consumer Finance Market.” This was done in response to an executive order issued by President Biden in July 2021 to evaluate the effects of competition generated by fintechs and other new entrant non-bank firms as they enter into the consumer finance market. The report highlights both the consumer benefits and risks from this increased competition. Below are the key points that financial institutions and fintech companies should take away from the report.

Overview of Current Market Landscape

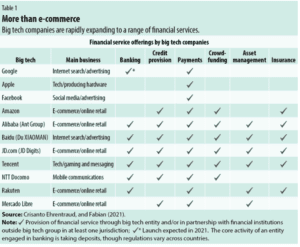

The report acknowledges the technology struggle many financial institutions are encountering when dealing with legacy technology, limited resources, or the lack of technical expertise needed to adapt their prior brick and mortar practices to an evolving world that highly leverages technology. This has created a gap that several new entrants and technology savvy businesses have fought to fill. These new entrants typically do not offer a full suite of services and sometimes carefully design their offerings to avoid the regulatory scrutiny that is placed on traditional financial institutions. Big tech and fintech firms’ increasing market share and strategic decisions to avoid regulatory requirements has reintroduced questions regarding how to level the playing field. The report examines the current landscape as pictured below.

The Current Landscape

Considerations Regarding Current Competitive Landscape

Key points to consider regarding the current landscape and evaluating competition include:

- The pace of change coupled with a lack of data on non-bank activities makes a comprehensive assessment and side-by-side comparison between new and incumbents difficult. Where there is a lack of data, the report makes observations. The bottom line is that a portion of the report is speculative. This intense pace of change is highlighted within the discussion of fintech competition with the significant increase in funding and IPOs for fintechs in 2020-2021, but significant declines in funding in 2022.

- Most financial institutions are partnering with these new entrants to augment services versus building similar capabilities themselves. This makes the true state of competition difficult to analyze as there may be many relationships between incumbents and new entrants.

- The report highlights how changes being made by core providers should help financial institutions integrate with fintechs, increase speed to launch, and reduce cost. It is important to note that these changes to allow better core integration are all in their early years and it will be interesting to see if they have the desired results for financial institutions.

- Although it didn’t make the final recommendation section, the report highlights that additional scrutiny of core providers may be warranted to promote competition.

Trends to Watch

The lack of data and an evolving landscape leaves a lot of current unknowns and areas that should be monitored, as they could play a significant role in shaping competition and future regulation.

- Although in recent years Big Tech companies in the U.S. have gotten more involved in the payment space leading to advances, Big Tech’s involvement and market share in the U.S. throughout the financial sector is much smaller than in other countries. The report dedicates a whole section to exploring the impact Big Tech could have if they pursue more services in this space – something Big Tech companies have done in other countries. It examines the potential ramifications to consumer data, market domination, fair pricing, and merger and acquisition. If domestic or foreign Big Tech enters the U.S. financial market with more intensity in the coming years, what impact will that have to products and competition in the financial space?

Source: figure courtesy of IMF

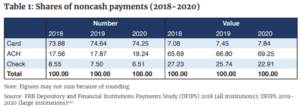

- Usage of existing payment rails has been shifting with a significant move away from cash and checks to card and ACH transactions. With the pandemic, ACH saw a heightened increase. What effects will the Federal Reserve proposed guidelines for allowing non-banks access to these rails, as well as the introduction of The Clearing House’s real Time Payments Network and the Fed Now product, have on competition to these networks?

Source: figure courtesy of the Treasure Department

- Generational adoption of products may change the risks poised by fintech and Big Tech, particularly regarding digital wallets and the holding of uninsured deposits. Older generations typically have held limited cash within digital wallets, but younger generations are flocking to digital banks and wallets. If this trend continues, how long will it be until there is pressure to increase regulation in this space and protect these consumers from potential harm of having uninsured deposits?

Source: Cornerstone

Key Opportunities and Risks

Overall, the tone of this article strikes a balance between the opportunities that new entrants are providing to the space, as well as the risk they propose to stability and potential consumer harm. Areas where new entrants appear to be benefitting the financial ecosystem include:

- Ability to reach and serve financially excluded consumers

- Expanding access to credit through alternative approaches to underwriting

- Greater access to user-friendly and accessible payment tools

- Increased access to low-cost transaction accounts

Although the report points to many benefits arising from these new entrants on the scene, there are several concerns it raises about the impact that they may have to the financial framework and the consumer. These echo concerns that we’ve seen other regulatory agencies raise as current priorities. Below is the list of concerns mentioned in the report along with my suggestions on actions that fintechs should be implementing to offset these risks.

| Concerns | Action |

| Overborrowing | Even when utilizing alternative credit models ensure that you are obtaining a full picture of the borrower’s commitments and monitoring their ability to repay.

|

| Bias and Discrimination | When deploying complex algorithms, machine learning (ML), or artificial intelligence (AI), ensure that initial development and ongoing monitoring has been established to identify assumptions that may create bias or discrimination.

Perform back testing of underwriting decisions to ensure that unintended discrimination is not occurring.

Ensure you obtain a thorough understanding of third parties use of complex algorithms, ML, and AI. Verify that they have performed sufficient testing and third-party verification of their models.

|

| Data Privacy and Reliability | Have a clear understanding of various state laws’ requirements regarding data privacy.

Develop a data governance program to ensure all entry and exit points of data are known and properly safeguarded.

Perform regular penetration testing and social engineering testing to ensure your data is secured. |

| Fraud | Perform or enhance your fraud risk assessment to consider all aspects of your digital transformation journey, including partnerships.

Verify that fraud monitoring controls properly address new types of services offered. This may mean altering or creating new rules to capture different activity. |

A significant portion of the report discusses the ways that new entrants may be taking advantage of lesser requirements and sidestepping regulation aimed at protecting the consumer. Financial institutions partnered with fintechs – and fintechs themselves – should be aware of the following areas that may garner increased regulatory scrutiny based on the report:

- New entrants partnering with small card issuers and misusing the exemption from a regulatory limit on interchange fee.

- A similar concern is raised related to electronic payments and partnering with financial institutions that are exempt from the Durbin Amendment, which restricts interchange transaction fees that can be assessed.

- The use of “tipping” or other practices that require money to paid to close a loan but are not included in the fee disclosure.

- Selecting partner financial institutions so as the evade obtaining a state lending license especially in states with strong consumer protection requirements, resulting in predatory lending.

Report Recommendations

The report concludes with several recommendations. Here are the four main points you should walk away with:

1. Improvements in Underwriting:

The report recognizes the shortcomings in consumer credit underwriting and microlending along with the need for innovation to provide alternatives to traditional credit scoring models. While it applauds the efforts that new entrants have made in this space, it acknowledges that more research needs to take place to make sure alternative scoring methods are accurate and do not discriminate. A strong model risk management and model validation program can help address these concerns, but the existing model risk management guidance needs to be strengthened to consider use of alternative data, machine learning, and other complex algorithms. The OCC 2021 Model Risk Management handbook made some attempt to address this but expect more guidance to come from all regulatory bodies.

2. Traditional Financial Institution & Fintech Relationships:

If you haven’t heard the message from the regulators yet that there will be increased scrutiny between financial institution and fintech relationships, this report definitely cements that it’s a trend that is here to stay. In addition to the consent orders and regulatory comments that we have seen over BSA and AML programs, I would anticipate an overall increased scrutiny on risk management practices to ensure that risks discussed above are properly safeguarded. Financial institutions and fintechs need to work together to properly design and support each other with their risk management program.

3. Increased Scrutiny Over Other Players

Incumbent non-bank lenders programs that have flown under the radar are specifically called out in the recommendations as an area that should come under the CFPB scope. It also states that the CFPB should consider oversight of data aggregators handling consumer approved financial data.

4. Protecting Consumers Right to Data

The report calls for finalization of guidance related to Dodd-Frank Act Section 1033 with the aim to support consumer approved sharing of their own banking data to facilitate innovate consumer products. If this is pursued, it could mean that we have a national data bill versus the ever increasing number of states trying to individually enhance data standards.

Conclusion

As the current landscape continues to shift, the regulators will be proceeding with caution. Overall, the report encourages the continued use of innovation to better financial services but financial institutions and fintechs need to ensure they are protecting consumers through proper oversight and controls. If you have any questions about this changing landscape or need assistance with your risk management practices, Wolf is here to help.

Contact