Audits may seem burdensome enough with the request lists, meetings, and follow-up questions, so why are they are now becoming increasingly more expensive? Here are two main drivers that can be pointed to:

Inflation

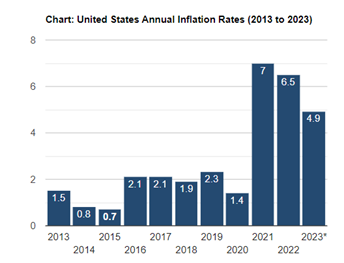

Over the past three years, goods and services have become increasingly more expensive. The chart below from the United States (U.S.) Bureau of Labor Statistics shows U.S. inflation rates from 2013 to 2023. Inflation numbers in the U.S. rose aggressively from 1.4% in 2020 to 7% in 2021 and dropped from 6.5% in 2022 to 4.9% in 2023 so far.

U.S. Bureau of Labor Statistics

*2023 includes April numbers as these are the most recent available.

Staffing

When inflation is rising, salaries and benefits are also rising. The climbing cost of benefits contributes to an employers’ labor-related expenses. Additionally, beyond inflation, there is also a lack of accountants seeking employment. According to the Wall Street Journal, “more than 300,000 U.S. accountants and auditors have left their jobs within the past two years, a 17% decline.” As baby boomers retire, companies seek succession plans; however, there’s been a 9% decline in accounting students in 2020 compared to 2012. There are multiple reasons for this decline, including the misconception of repetitive tasks, long hours, and the need to be good at math. Accounting firms have found themselves paying top dollar for their staff right out of college to match the competition and boost compensation packages for their current staff to retain talent.

Not only is there a decline in accounting students, but there is also a decline in accounting students entering public accounting. This is due to the increase in competition from the tech and consulting industries and the common desire to make more money in these niches up front, instead of a few years in public accounting. Previously, the industry norm was to go into public for a few years to get the experience and then decide which industry is the right fit. To combat this decline, accounting firms have improved their recruiting efforts by recruiting earlier at colleges and high schools, bringing on more interns to get a feel for the industry. These efforts also include hosting more events and recruiting non-traditional hires such as part-time, working parents, and those who have left public accounting for a private industry.

Additionally, fewer people are taking the certified public accountant (CPA) exam, which adds to the issue of succession plans in accounting firms. Many CPA firms require the CPA exam to be promoted to a certain level, usually a senior or a manager. Without individuals taking and passing the exam, there are fewer qualified employees for these positions. Passing the exam is crucial for a career in public accounting as it stands now, however this process comes with its barriers. For example, to obtain a CPA license there is a 150-credit requirement. In this case, many students don’t want to face the cost of extra classes and additional time spent in college as opposed to beginning their careers. Other barriers include the time, cost, and timing restrictions of the exam. Therefore, there seems to be less urgency to take and pass the exam since there are other viable options for accounting students besides public accounting.

It is important to note, there are some special considerations for specific industries or clients with other complexities, which adds to the cost. These complexities may include reporting on internal controls instead of financial reporting or a change in accounting standards that requires additional work. However, inflation and staffing are two general factors across all industries. To mitigate this rising cost, talk to your accounting team on ways to decrease pricing, such as alternative timing than busy year ends, remote audits instead of incurring travel expenses, and readiness for the assigned timing.

If you have any questions about audit services, our team at Wolf & Company is here to help.