Are you a supplier, service provider, or other vendor to large corporations that do business in California? If so, then this article is for you. You very likely will be called upon to feed into California’s new climate-related regulatory reporting requirements.

What Do the Laws Require?

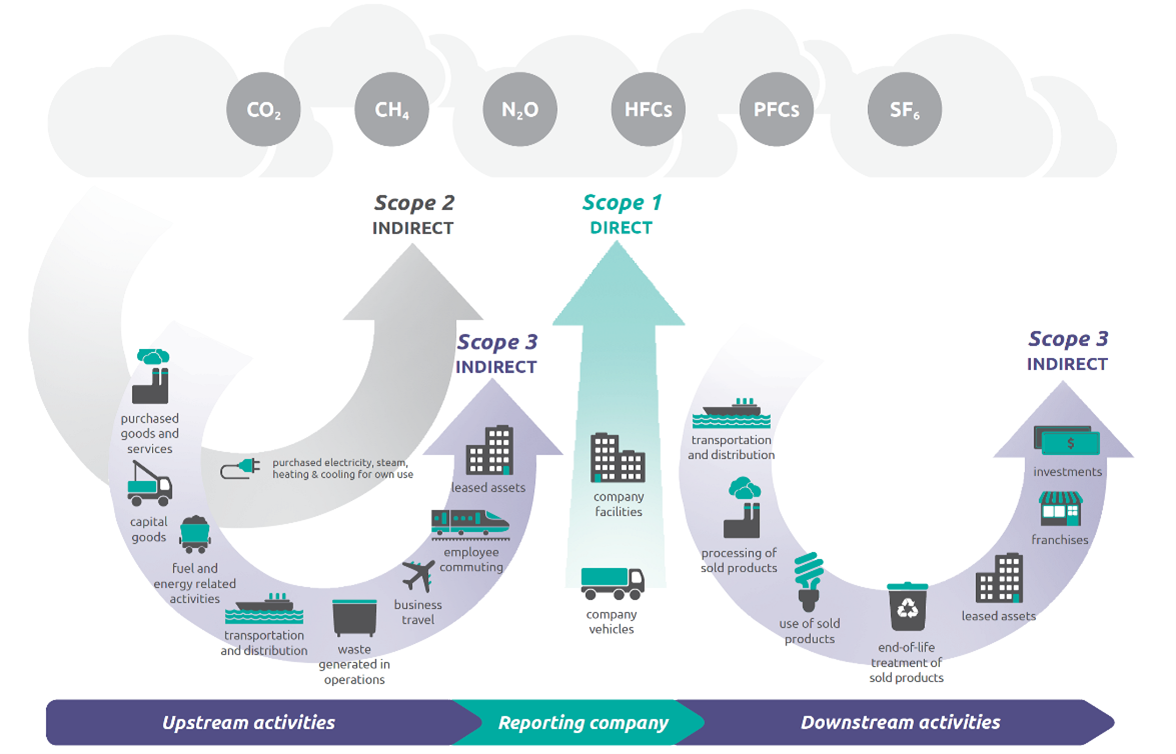

The laws will require large corporations, both public and private companies, operating in the state of California to disclose both their carbon footprints and their climate-related financial risks. The Climate Corporate Data Accountability Act (Senate Bill [SB] 253) requires companies with annual revenues in excess of $1 billion to file annual reports publicly disclosing their Scope 1, 2, and 3. The Climate-Related Financial Risk Act (SB 261) requires companies with $500 million in annual revenues to prepare biennial reports disclosing climate-related financial risk and measures adopted to reduce and adapt to that risk. Because of the nature and complexity that GHG reporting raises, we focus the remainder of this article on SB 253.

SB 253

The bill requires companies with total annual revenues greater than $1 billion and do business in California, referred to as “reporting entities,” to publicly disclose the following to the emissions reporting organization of the state board:

- Scope 1 and 2 (See graphic below) GHG emissions, annually, beginning in 2026; and

- Scope 3 (See graphic below) GHG emissions, annually, beginning in 2027.

The specific due dates of the reporting beginning in 2026 and 2027, due annually thereafter, have not yet been determined by the applicable state board.

Courtesy of the Environmental Protection Agency

Reporting entities will need to engage an independent third-party assurance provider to audit the GHG disclosure report before submission.

The reporting entity will be required to file the assurance provider’s report on the GHG reporting along with the GHG reporting. The assurance engagements for Scope 1 emissions and Scope 2 emissions shall be performed at a limited assurance level beginning in 2026 and at a reasonable assurance level beginning in 2030. The assurance requirement will also cover the Scope 3 emissions, at a limited assurance level in 2027 and requires reasonable assurance beginning in 2030.

The bill creates the Climate Accountability and Emissions Disclosure Fund which will be funded by the fees paid by covered reporting entities. A reporting entity, upon filing its disclosure report, will be required to pay an annual fee (amount not yet set by the CA state board). Furthermore, reporting entities subject to the bill can face penalties of up to $500,000 for non-filing, late filing, or other failure to meet reporting requirements.

The Impact as We See It

Are you a supplier to big manufacturers such as General Motors, Ford, Tesla, or others? Are your products on the shelves of Target, Costco, Walmart, Whole Foods, or other retailers? Are you a service provider or vendor to Google, Meta, Apple, or other large companies that operate in California? Whether your company is privately held or based outside of California, SB 253 very likely will still impact your business.

Even prior to this CA climate bill, we were starting to see large corporations get more refined with their GHG emissions targets to include the upstream and downstream effects from vendors, service providers, transportation networks, and suppliers.

Salesforce Inc. now requires suppliers to disclose Scope 1, 2, and 3 emissions, deliver products and services on a carbon-neutral basis, and fill out a supply scorecard each year. AstraZeneca suppliers are expected to annually report emissions data to the Climate Disclosure Project and set science-based goals. Per its recently released sustainability report, starting in 2024, Amazon.com, Inc. will require suppliers to share their emissions.

Suppliers are often the biggest component in total emissions, yet niche manufacturers and contractors face financial and resource limitations. Amid ongoing fears of recession, higher interest rates cutting into sources of capital, signs of weaker consumer demand, and labor market challenges, small businesses may still be required to implement GHG measurement programs, or they will risk losing business.

The only benchmark currently included in the bills to determine applicability is total revenues. This presents the obvious question about which industries appear to be escaping this regulation now but might be scoped in from subsequent amendments to the laws. If a benchmark based on total assets were added, this would inevitably scope in many financial institutions that are currently not directly impacted.

Where Does Wolf Fit In?

Consulting

By staying up to date with recent regulatory announcements and reporting trends, Wolf can be your trusted advisor in identifying reporting requirements and sharing the knowledge with management and the Board of Directors to make informed decisions.

Outsourced GHG accounting

We are ready to assist companies in the accounting and reporting of GHG emissions.

Assurance

As a 112-year-old CPA firm, we have addressed complex and evolving assurance requirements from new and existing regulatory bodies for over a century. We are ready to be your partner to audit your GHG disclosures.

Do you anticipate your company will be subject to the reporting requirements, either directly or indirectly through your value chain? Are you invested in companies that might be impacted? Get started on your climate-risk assessment and building measurement programs with Wolf. Contact us to discuss what’s relevant to your business and how to prepare for this compliance.