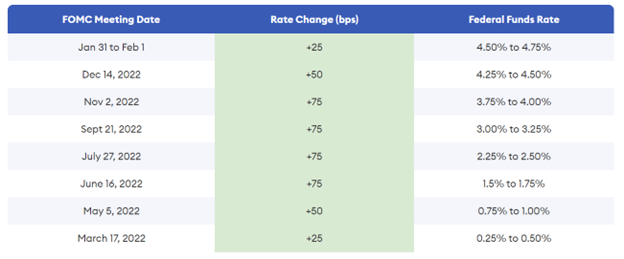

Any industry that lost $1.5 trillion in market cap in a year, as crypto did in 2022, would be anxious to put that year in the rearview mirror. But crypto wasn’t the only market experiencing singular events. Although it feels like a million years ago now, the Federal Reserve’s first federal funds interest rate hike was in March 2022 with an increase of 25 basis points. It was followed by six more hikes throughout the remainder of 2022, including four 75 basis point increases. Without a doubt, this was one of the Fed’s most dramatic interest rate moves in history.

These charts exhibit a strong negative correlation between the fed’s interest rate levels and the market cap of crypto. Crypto and other risk assets certainly felt the effect of the “risk off” trade that occurred as interest rates rose. So, it’s reasonable to anticipate as rates level off and even come down that we move from a “crypto winter” to a new “crypto spring.”

Not surprisingly, this dramatic change in the interest rate environment was a significant contributor to the crypto market’s decline. If digital assets are supposed to be a new and distinct asset class, why did it respond to this increase in interest rates? Risk assets are generally most impacted by interest rates. Consider the process of discounting back to today far away future cash flows at increasingly higher interest (discount) rates. Digital assets are generally viewed as the riskiest of risk assets. So, in that sense, the declines made sense in an environment of rapidly rising interest rates. It’s the same reason the Nasdaq index lost more than 30% in 2022.

But what about bitcoin? Wasn’t it supposed to be a hedge against inflation with its strict fixed supply? Yes, in theory. In practice, bitcoin has been viewed primarily as a high-risk asset and has traded consistently with other high-risk assets. In fact, the correlation between the largest digital assets and the broad equity markets increased over the course of 2022. In the future, bitcoin could be viewed more as a store of value (i.e., digital gold) with a higher correlation to general volatility and inflation. But for now, bitcoin will continue to trade in line with other risk assets.

If you are someone who believes the US may have hit peak inflation and therefore peak Federal interest rates, you might look for 2023 to show a reversal of the trend outlined above. That is certainly one possibility, but far from a sure thing. Let’s not lose sight of why the Fed raised interest rates so dramatically in 2022 and has continued to do so into 2023 – to bring down inflation.

Price stability is one of the Fed’s core mandates, along with full employment. Higher interest rates tend to slow the economy which tends to put pressure on corporate earnings. Lower corporate earnings could mean pressure on stock prices. If the correlation between equity markets and crypto markets remains that could mean pressure on the crypto markets as well.

Only time will tell what happens with crypto prices, but one thing we have learned for certain is that the overall economy and economic trends are likely to have a significant impact on the crypto markets.